Beta Beast Mode

Nobody leaves a negotiation happy! Football, Russia, & Risk!

Ukraine-Russia Crisis

We just learned about stock-specific risks (systematic) above, aka Beta. The Russia Ukraine crisis brings geopolitical risk to your portfolio or your kids.

🌍Geopolitical risk is about relations between nations – at the political, economic, military, and cultural/ideological level.

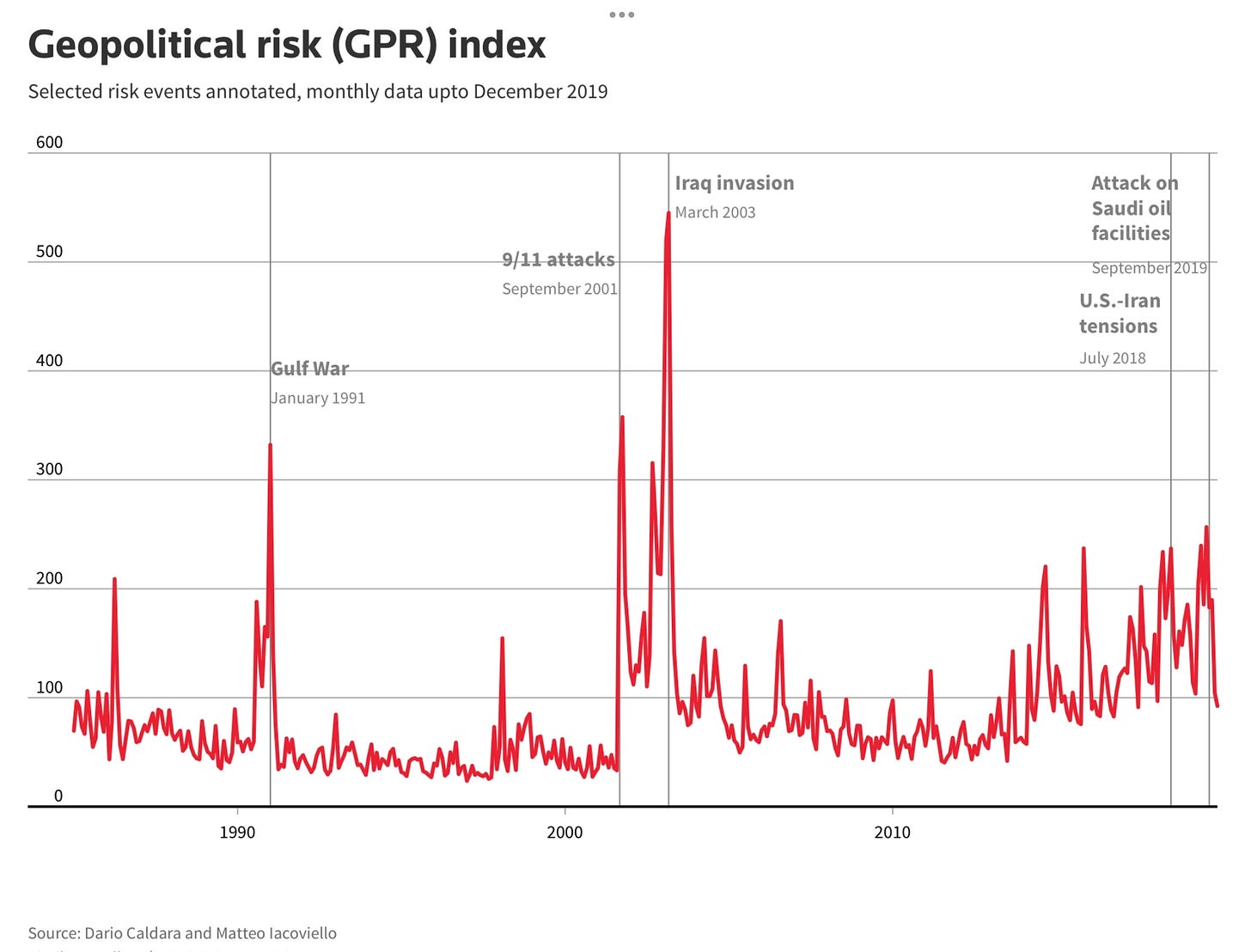

🌍How is this measured? - This isn’t measured by Beta. Geopolitical instability is measured by the Geopolitical Risk Index (GPR).

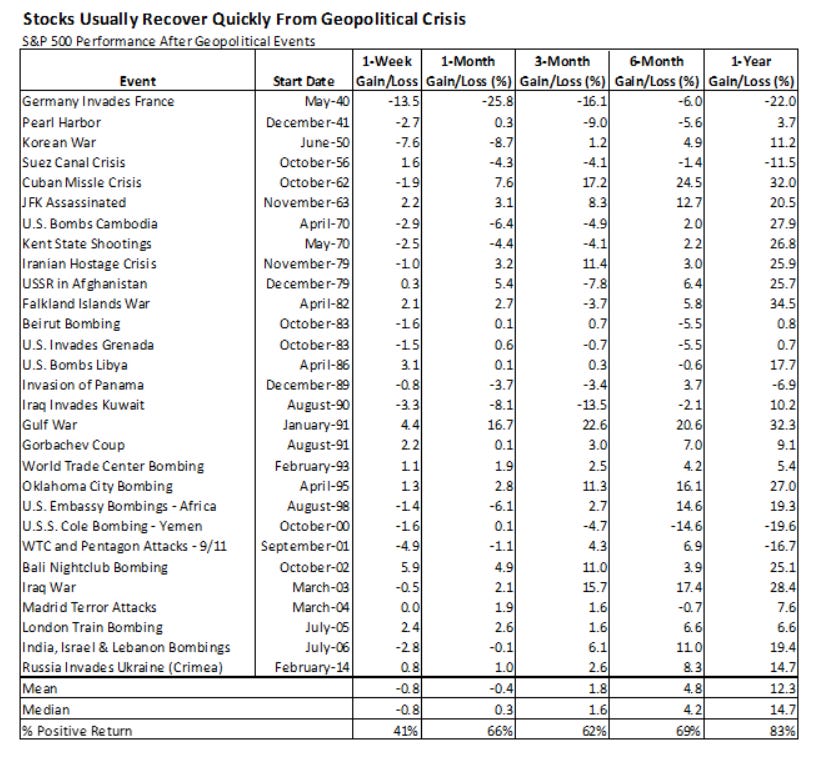

Here is a list of geopolitical events and how the market has responded historically.

Lesson!

😡The VIX is another measure to view the overall stock market risk sentiment levels. Think of this as a mood ring. In short, the higher this is, the more uncertainty present.

💸It’s also important to know how Russia makes money!

🛠Russia makes money from exporting oil, gas, and metals. Approximately 75% of what they export to the world. Most of this is important to the European economy.

💡In terms of imports for the Russian economy. Russia imports 5% of goods from the US, 65% from China, and 30% from Europe. (source: Emerging Advisors Group)

🐟 In short, from an import/export perspective, the US isn’t a big fish in Russia’s pond. So the impact on US companies is likely minimal at best.

Lastly, I’ll end it with a quote from my boss: “We know almost nothing with certainty.”

Uncertainty brings the highest probability for mispricing! Some run from it, and others lean in. In short, this stock explorer is leaning in.

S&P 500 Sectors YTD% (Source: Finviz)

Chilling but True…

👋 Have a nice weekend, stock explorers!