Diversified Dream

My favorite yoga instructor Kirra Michel once said:

“People often say: I am sad, worried, or angry: But people often forget emotions like the weather are cyclical. Emotions come and go. You are the clear blue sky. You are steady.” - Kirra Michel

Anyone familiar with investing knows that it can often be emotional. The basis for many behavioral financial studies is emotion, and the most intelligent investors in the world make mistakes based on emotions.

Something that helps calm temporary market emotions is diversification.

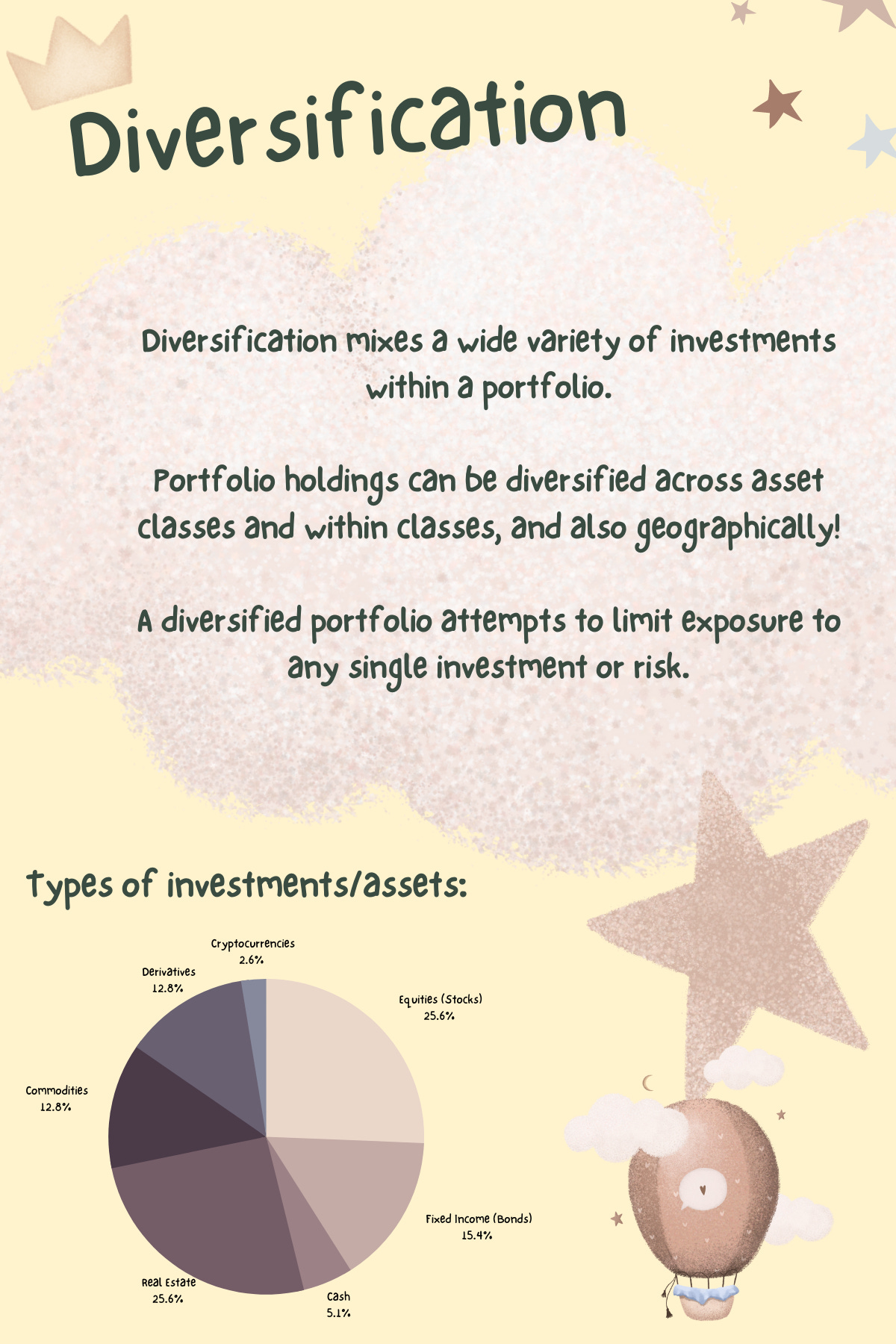

It’s having a mix of investments and not putting all of our eggs into one basket.

You see, if we put all our money into one stock and depended on that one company's success. We would be extremely emotional & unstable when they fail. We may even deny any flaws and begin anchoring.

As one of my favorite investors, Sir John Templeton, would say: “Bull markets are born on pessimism, grown on skepticism, mature on optimism and die on euphoria. The time of maximum pessimism is the best time to buy, and the time of maximum optimism is the best time to sell.”

Reverse psychology at its core.

So, how do we achieve success in investing?

There is no optimal formula or allocation to stocks, bonds, money market funds, index funds etc.

However, what I do know is that I haven’t met a single soul who is right about investing 100% of the time. Most of us have to diversify and learn from mistakes when they do happen.

Risk & Reward

Important to know lowering the risk of your portfolio (increasing diversification) can also lower the potential return.

So risky bets can pay off big, but it’s almost impossible to know that with 100% certainty. Take Amazon for example!

If I knew then what I know now! (I was 12 years old in 2006)

Food for thought, literally!

It’s similar to your diet - If you ate one type of food daily and didn’t diversify, you would eventually get sick of it.

For example:

My youngest brother Richie who is a proud Stock Explore supporter and my right-hand man when it comes to photos/video - used to only eat Celeste frozen pizza.

He did this up until he was 14 and realized he couldn’t go on a date with a girl and order Celeste.

Now he’s diversified! He eats sushi and pasta, Burgers, etc. He has diversified his diet and is no longer single—sorry, ladies.

Now Apply this to investing!

You may really love investing in EVs and think there the future, so it’s tempting to just bet it all on a company like Tesla (TSLA) with a revolutionary goal and crazy CEO. However, this is extremely risky!

So it’s probably best to diversify some of the risk of a potential dip away by adding to other names, may be holding onto a municipal bond, and some stable dividend stocks for income purposes. (Dinosaur Dividends)

Or, if you're like me - I love consumer stocks, but no one can estimate the pressure of inflation & inventory pressures. So if I had all of my money in consumer names, I would really be crying!

I need other sectors and companies to anchor down some of the heat when things start to boil up.

Diversification doesn't remove the market's cyclical nature, but it does help temper our emotions. Keeping the sky blue.

Resources To Explore!!

Investopedia - Diversification

How Legendary Investor John Templeton learned to put his eggs in different baskets!

Warren Buffett - Yahoo Finance

Bloomberg: Retail Sales - Consumer Spending

NEFE Financial Education Mandates

Raise your hand if you think Julia Garner deserves every award - Ozark & The Emmys

Stock Explore has a number of exciting initiatives down the pipeline, and I can’t wait to share them with you all!

This concludes volume 1 of Stock Explore’s first comic series! Thank you for being part of this journey.

Stay tuned for updates & as always, keep exploring!

Sincerely,

Nicolette DiMaggio

Chief Stock Explorer 🧭

Disclosure: The materials included are not to be considered advice. Stock Explore is for informational purposes only.