I am back! Sadly no comic this time. Just here to shed some light on recent events.

You may have noticed my first comic on Inflation. This is where I teach the fundamentals of inflation and popular metrics used to track it.

Connected to the word inflation is one of the most powerful institutions in the US, otherwise known as the Federal Reserve or The Fed!!!

This guy is named Jerome Powell - he is the president of the Fed.

The Fed’s core responsibility is to keep our economy stable. They do this through setting interest rates, managing our money supply, and regulating financial markets.

Now I like to think of this as a huge workshop for the best economists, and in this workshop, they have several tools to help ensure our economy is well stable and doesn’t crumble into pieces.

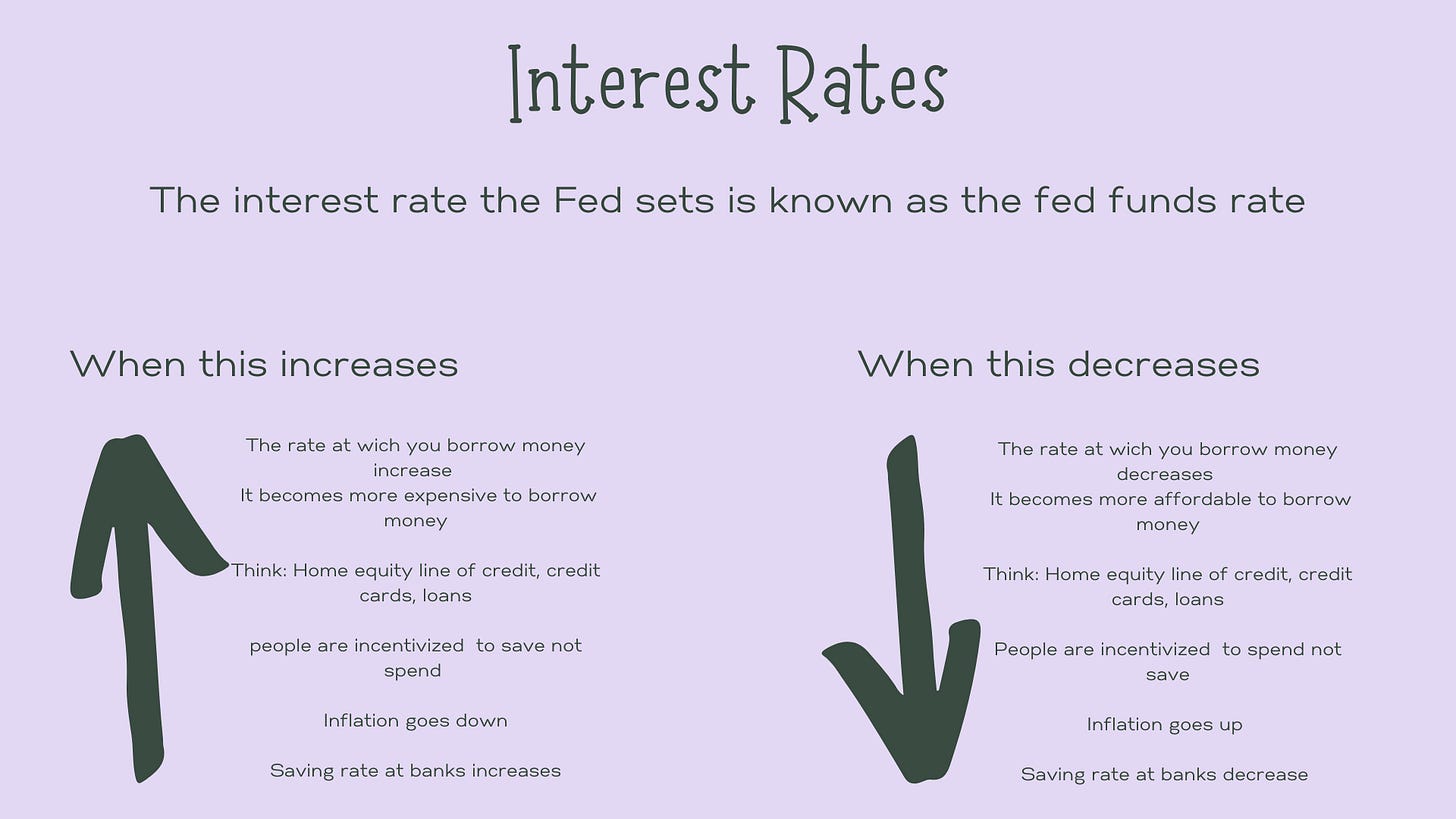

The Interest Rate Tool (Translated into simple Stock Explore terms)

The Money Supply Tool (Translated into simple Stock Explore terms)

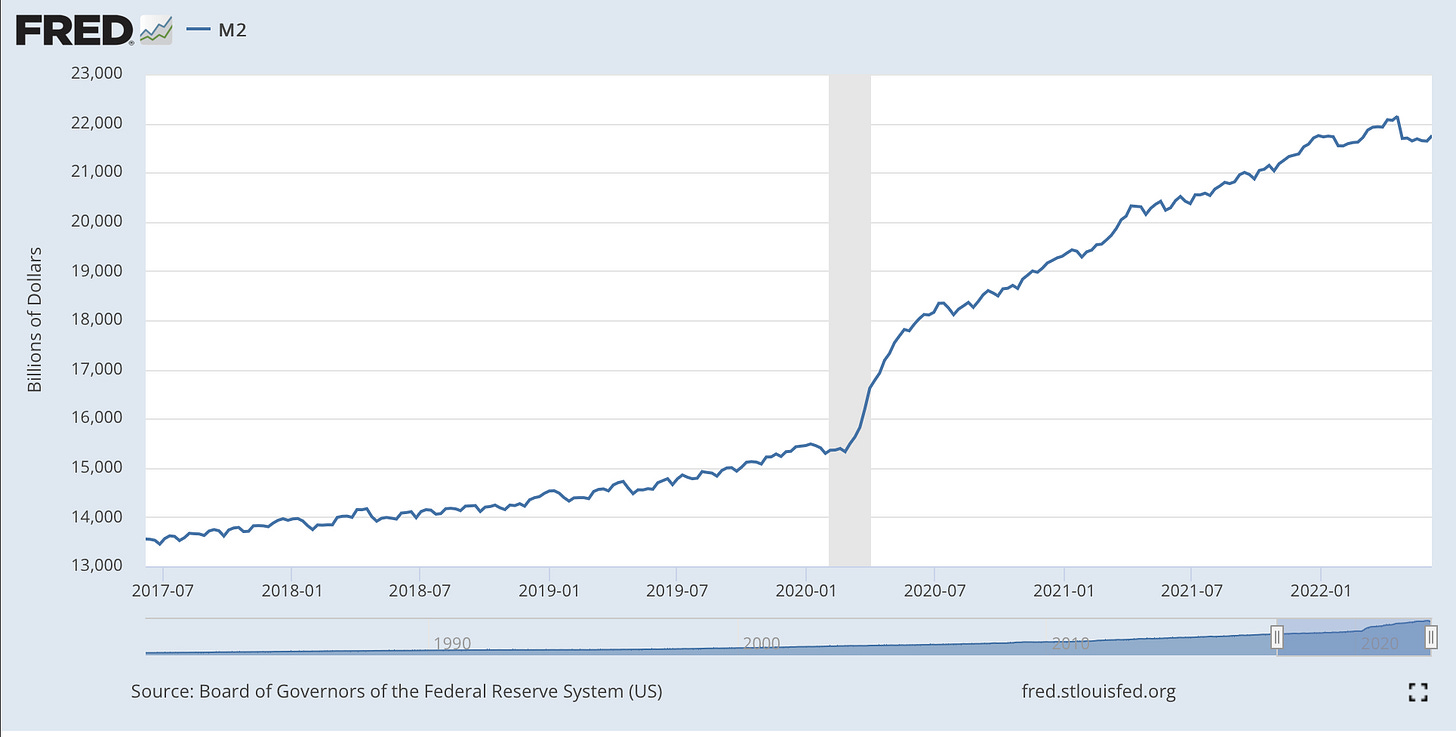

Now many financial news outlets and blogs will reference M2. As much as my mind wants to wander to Star Wars and think this is a distant cousin of R2D2, I am not talking about a robot.

I am talking about money, otherwise known as the money supply in our economy.

M2 is the Federal Reserve’s leading money supply tool.

💰 M2 includes cash, checking accounts, plus savings deposits (less than $100,000) and money market mutual funds. M2 is used to measure how much money is in the economy and is closely watched as an indicator of money supply and future inflation.

What’s happening now?

As the notorious B.I.G. would say, “Mo Money Mo Problems.”

M2 has increased 44% (Feb 2020 - April 2022) & is now contracting!

Real M2 is contracting at a 3.8% annualized rate. This is the sharpest contraction since May 1980.

So we are now trying to unwind all those fancy stimulus checks so many Americans were happy about because the reality is; money doesn’t fix the problem. It may temporarily serve as a band-aid, but at the moment, the band-aid is being ripped off.

Why?

Because all this money has caused inflation to grow at record rates!

(Source: WSJ)

The driver of inflation was money printing designed to enhance the "stimulus" of government handouts during the pandemic, and that has grounded to a halt. This is great news in a way because the main thing causing inflation to skyrocket has halted.

However, the lags between money and inflation are "long and variable," according to Milton Friedman.

Stock Explore’s Prediction

I don’t see inflation slowing down this year for a few reasons.

(1) Spending Mindset

People are continuing to spend because we have developed an entire population with a spending mindset. The wave of financial literacy is just beginning, and we as a society have failed to form savings, investing, and giving mindsets. Only a few of us have developed this, and it isn’t the majority.

Just look at the headlines!

“Consumer spending accounts for 70% of our economy” (The Times)

“Americans now have an average of $9,000 less in savings than they did last year” (CNBC)

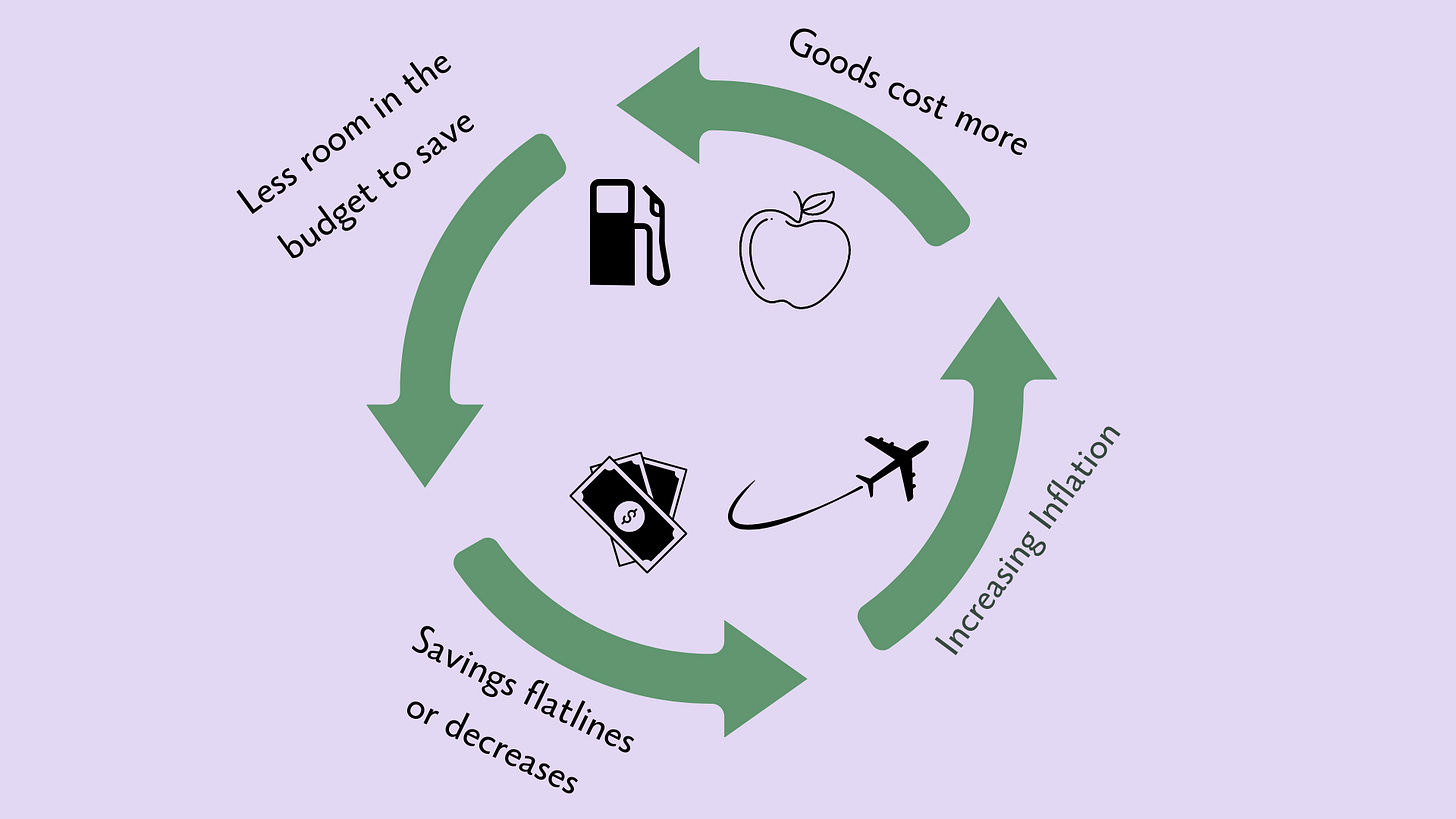

Also, trying to entice people to save when they have less wiggle room in their budget is a vicious cycle.

(2) The Wedding Boom

I may have a bias as a Bride to be, but there will be 2.5 million weddings in 2022 from the pent-up demand brought on by the pandemic! This is the most weddings since 1984.

The average cost of a wedding is up +19% Y/Y !(wedding reports)

2021 = $21,000

2022 = $25,000

Looking at the CPI’s top contributors. If you are attending a wedding, you will most likely fall into multiple buckets that are leading contributors to inflation. To name a few; Gasoline, Airfares, Furniture, Lodging away from home, and Apparel.

With many couples pushing out the demand for weddings to 2023, I don’t see this slowing. At least in 2022, maybe there is hope for 2023!

As grim as I may sound, I do think the surge in our money supply (M2) was a one-off reaction to an extreme crisis. This phenomenon began in 2020 and continued till Q3 2021. Many investors were flying blind, and companies made extreme supply chain estimates to keep up with the “new normal” before we even normalized! (cough cough: Peloton)

Since the end of 2021, our federal deficit has plunged, and M2 growth has decreased substantially. Are dollar is now stronger (to help soak up M2) and despite copper prices signaling a recession. I do think, better horizons are up ahead; how far ahead is something I will never try to predict.

Resources To Explore!

Amazon has been slashing its Private Label selection!

Amazon Prime Day Sales +20% Y/Y